All Categories

Featured

Table of Contents

The technique has its own advantages, however it likewise has issues with high charges, complexity, and much more, causing it being considered as a fraud by some. Boundless banking is not the very best plan if you need only the financial investment part. The unlimited financial concept focuses on the use of whole life insurance coverage policies as a financial tool.

By leveraging the cash value of a whole life insurance policy, policyholders can create a private banking system (best whole life insurance for infinite banking).

Certified advisors specialize in helping clients maximize their policy’s potential. Unlike traditional financing methods, Infinite Banking provides full liquidity, allowing policyholders to become their own bankers. Speak with an expert today to unlock the potential of Infinite Banking.

A PUAR permits you to "overfund" your insurance coverage policy right as much as line of it becoming a Customized Endowment Contract (MEC). When you make use of a PUAR, you quickly boost your cash worth (and your death advantage), therefore enhancing the power of your "bank". Better, the more cash worth you have, the better your rate of interest and reward repayments from your insurance provider will be.

With the rise of TikTok as an information-sharing system, financial recommendations and techniques have actually found a novel way of dispersing. One such approach that has actually been making the rounds is the boundless banking principle, or IBC for brief, garnering endorsements from stars like rap artist Waka Flocka Flame - Wealth building with Infinite Banking. While the technique is currently prominent, its origins map back to the 1980s when economist Nelson Nash introduced it to the globe.

Who can help me set up Infinite Banking In Life Insurance?

Within these policies, the money value grows based upon a price established by the insurance firm. Once a significant cash worth gathers, policyholders can acquire a money value loan. These car loans vary from conventional ones, with life insurance serving as security, suggesting one can shed their protection if loaning exceedingly without appropriate cash worth to sustain the insurance policy expenses.

And while the appeal of these plans is evident, there are inherent restrictions and threats, necessitating attentive money worth tracking. The strategy's legitimacy isn't black and white. For high-net-worth people or local business owner, particularly those making use of techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance development can be appealing.

The attraction of unlimited financial doesn't negate its challenges: Price: The foundational need, a long-term life insurance coverage policy, is pricier than its term equivalents. Qualification: Not everybody gets whole life insurance due to extensive underwriting procedures that can exclude those with specific health and wellness or lifestyle conditions. Complexity and risk: The elaborate nature of IBC, paired with its risks, may prevent numerous, specifically when easier and less dangerous choices are available.

What financial goals can I achieve with Infinite Banking Account Setup?

Alloting around 10% of your regular monthly income to the policy is just not viable for a lot of individuals. Part of what you read below is just a reiteration of what has currently been stated above.

Prior to you get yourself into a circumstance you're not prepared for, know the adhering to first: Although the idea is generally offered as such, you're not in fact taking a loan from on your own. If that were the case, you wouldn't have to repay it. Instead, you're borrowing from the insurance provider and need to settle it with interest.

Some social media blog posts advise making use of cash worth from entire life insurance to pay down credit scores card financial obligation. When you pay back the car loan, a part of that passion goes to the insurance coverage company.

Is there a way to automate Infinite Banking Benefits transactions?

For the first several years, you'll be paying off the payment. This makes it incredibly difficult for your plan to accumulate value throughout this time. Unless you can manage to pay a couple of to numerous hundred bucks for the next years or more, IBC won't work for you.

Not everybody needs to count only on themselves for monetary safety. Generational wealth with Infinite Banking. If you call for life insurance, here are some important pointers to take into consideration: Consider term life insurance policy. These policies provide coverage throughout years with considerable financial commitments, like home mortgages, trainee financings, or when looking after kids. Ensure to shop around for the very best rate.

What is Policy Loan Strategy?

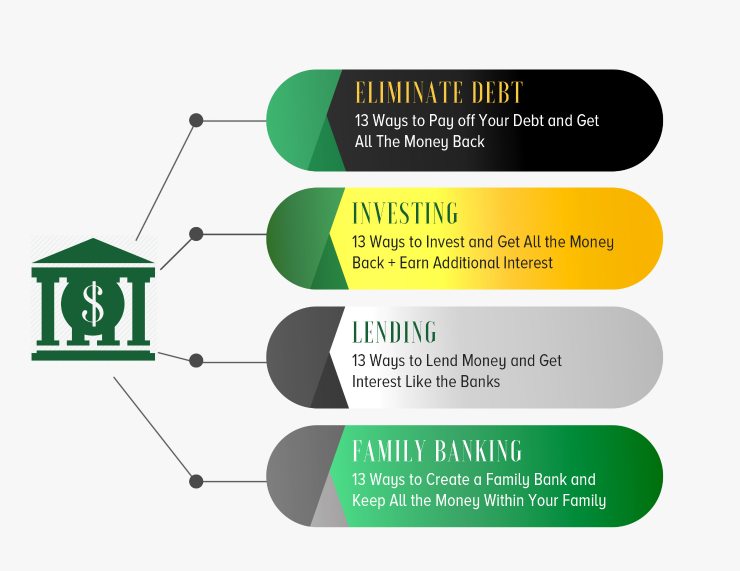

Envision never ever having to stress over bank financings or high rates of interest once again. What if you could borrow cash on your terms and construct wide range concurrently? That's the power of boundless banking life insurance policy. By leveraging the money worth of whole life insurance policy IUL policies, you can grow your riches and obtain money without counting on conventional financial institutions.

There's no set loan term, and you have the liberty to pick the payment routine, which can be as leisurely as settling the loan at the time of death. This adaptability reaches the servicing of the car loans, where you can decide for interest-only payments, keeping the finance equilibrium level and workable.

How do interest rates affect Infinite Banking Wealth Strategy?

Holding cash in an IUL fixed account being credited interest can frequently be far better than holding the cash on down payment at a bank.: You have actually constantly fantasized of opening your own bakery. You can borrow from your IUL plan to cover the first expenses of renting out an area, purchasing equipment, and hiring staff.

Personal fundings can be gotten from typical financial institutions and cooperative credit union. Here are some essential factors to take into consideration. Credit report cards can give a flexible means to borrow money for really short-term durations. Borrowing cash on a credit report card is typically very expensive with annual portion rates of rate of interest (APR) frequently getting to 20% to 30% or more a year.

Latest Posts

Be Your Own Bank - Infinite Growth Plan

Infinite Banking Examples

Is Bank On Yourself Legitimate